Got some extra time on your hands and want to start putting together a better financial plan looking forward? Perhaps you want to start saving or looking into some different investment methods for the future? To help get you inspired, take a quick look at this list of 5 different ways to come out of lockdown with a better grip on your finances.

Building up a savings pot

A great first place to start if thinking of ways to feel better about your financial situation is by saving up enough money to have a buffer or ‘rainy day fund’. Having that monetary cushion will not only give you something to fall back on should emergency payments arise or if something goes wrong, but it will also give you added peace of mind when spending money, too. Reaching financial freedom is really about not feeling constrained and trapped by your finances, and so taking this first step can help you to reach that goal.

Tip – Finding it hard to get started with saving significant amounts of money? Why not start small with one of the many different savings challenges available? Trying something like the 1P savings challenge, for instance, will allow you to incrementally save while testing yourself with a game at the same time. Smartphone apps such as MoneyBox and Plum can also be great motivators with regards to savings, too.

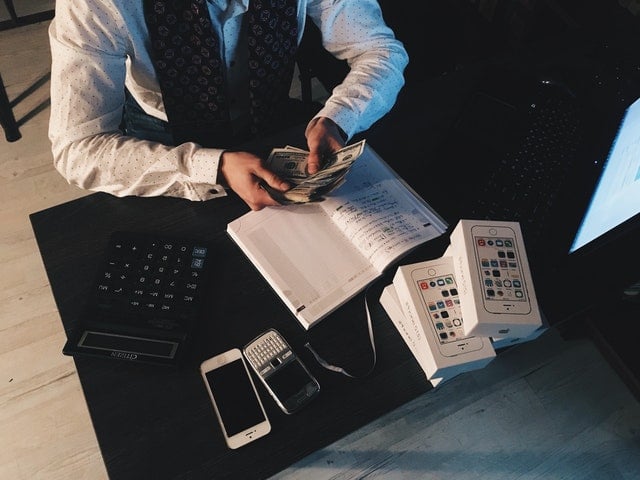

Pursue a side hustle

Got a passion or hobby that you’ve been spending a lot of time on over the past twelve months in lockdown? Why not think about that skill you’ve been honing in a different light, and see if there might be a way to monetise it? If you have a digital skill, for instance, such as graphic design, video production/editing, or SEO copywriting, you can easily get set up on a freelancing platform such as Fiverr or UpWork to offer your services.

Tip – Make sure with whatever work you do on the side as a passion project that you make a note of it in a portfolio. That way, when searching for freelance opportunities or future collaborations, you can show clear examples of the high-quality work that you’ve done, so that people don’t just have to take your word for it.

Investing for the future

If you have a bit of capital stored away and want to start building a financial portfolio, it’s easier than ever to get started in 2021. Many young entrepreneurs and savvy professionals are discovering ways to leverage the investment stock market using smartphone apps and services, and property investment companies such as RWinvest are bridging the gaps between property and investors by providing online materials and even virtual reality viewings. Depending on what your goals are and how much money you can afford to put into a strategy, this could be something to look into.

Tip – If interested in learning more about the property market, RW has a range of different podcasts, videos, and guides on different aspects of UK property for beginners. If interested in stocks and shares but unwilling to put your own funds in just yet, there are plenty of services – such as Trading212, for instance – that allow you to play around and experiment with hunches without any of the risks.

Would you like to publish your content with us and reach a large number of readers? Are you planning to advertise your business through a press release? If you are ready to improve traffic on your website, shoot us an email right now with your inquiry:

[wpforms id=”3957″ title=”false”]